The following information is effective for calendar year 2022. (Pacific time), except on state holidays. If you see a 0 amount on your form, call 1-86, Monday through Friday, from 8 a.m. Note: If an adjustment was made to your Form 1099G, it will not be available online. Employers are responsible for making the required deductions from their workers' earnings and forwarding all TDI withholdings to the Employer Tax Section each quarter along with all required Employment Security, Job Development Fund and Reemployment Fund taxes. Form 1099G tax information is available for up to five years through UI Online. A 1099-G tax form is issued to any individual who received unemployment insurance (UI) benefits for the prior calendar year. Temporary Disability Insurance TaxĮmployees pay this tax through payroll deduction to fund benefits for workers unable to work due to non work-related injury or illness. On April 22, the Indiana General Assembly passed an update to Indianas conformity to the Internal Revenue Code (IRC), but specifically decoupled from certain provisions. Be sure to include information from your Form 1099G. For information about the Governor's Workforce Board, please visit gwb.ri.gov. Your unemployment compensation is taxable on both your federal and state tax returns.

Each employer's Employment Security tax rate is reduced annually by 0.21% to ensure that this program does not result in a tax increase. The Governor's Workforce Board assists Rhode Island employers by funding a variety of projects designed to improve and upgrade the skills of the existing workforce. Job Development Fund TaxĮmployers pay an assessment of 0.21% to support the Rhode Island Governor's Workforce Board, as well as employment services and unemployment insurance activities. To view your 1099-G form if available, log into your MyUI+ account, then select View Correspondences from the left-hand navigation menu (or in the hamburger menu at the top, if you’re on mobile). Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers. 1099-G tax forms are now available in MyUI+ for many claimants who received unemployment benefits during 2021. Employment Security TaxĮmployers pay this tax to fund benefits for workers during periods of unemployment.

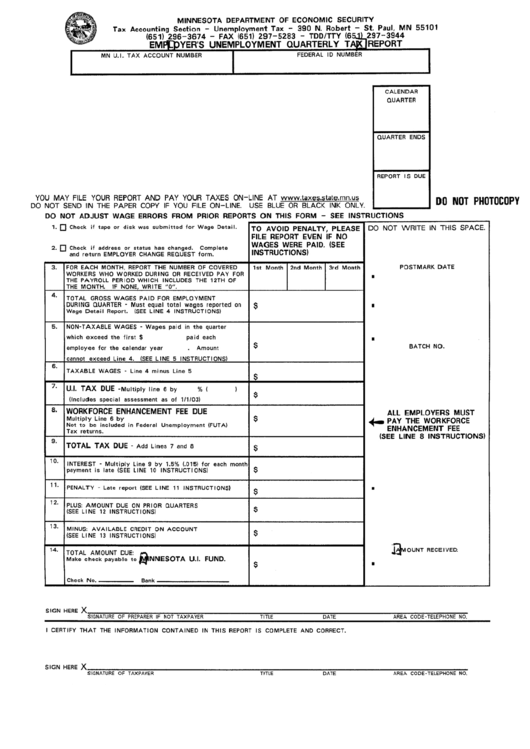

These payments include all required Employment Security, Job Development Fund, Reemployment Fund and Temporary Disability Insurance taxes. Type Name Covid19TERS-dispute-form: Form - UIF Electronic Declaration Specifications: Sworn Statement: UI-12notice-of-appeal-against-a-decision-of-a-claims-officer: UI19employers declarations: UI2. The Employer Tax Unit processes all Quarterly Tax and Wage Reports (Form TX-17) and accompanying tax payments, submitted by Rhode Island employers. Department of Labour Documents Forms Forms. These programs provide economic stability to workers, families, communities and the Rhode Island economy as a whole. The primary goal of the Employer Tax Unit is to provide and account for the funding needed to pay Unemployment Insurance benefits to eligible jobless workers, and Temporary Disability Insurance benefits to eligible workers idled by non work-related injury or illness. Worker Adjustment And Retraining Notification (WARN).Temporary Disability / Caregiver Insurance.

0 kommentar(er)

0 kommentar(er)